Here is your most comprehensive scoop of the stablecoin news this week!

Editor - Jackie

🚀 Introducing AllScale Invoice: the first feature in our Stablecoin OS.The fastest, most intuitive way for SMBs, creators, freelancers, and even AI agents to send invoices and get paid instantly in USDT/USDC! Start in 30 seconds (no KYC, no gas, no keys) and unlock seamless global payments.

💸 Plus: complete quick tasks HERE for a chance to win 50 USDT…(expect even MORE quests in the future)!!

🔗 Start invoicing today → http://dashboard.allscale.io

🌍 Macro: Ethereum stables hit $166B while USDC cements lead, Asia builds token corridor

Bernstein SocGen sees little threat to Circle despite competition - Bernstein SocGen reiterated an “Outperform” rating on Circle with a $230 target.

JPMorgan warns Circle faces ‘intense’ competition - Analysts said Tether’s USAT, Hyperliquid’s USDH, and fintech stablecoins will pressure Circle. The $278 billion stablecoin market remains under 8% of crypto’s total cap, with competition seen as a zero-sum game.

EY-Parthenon: stablecoins poised to transform payments - Currently, 13% of institutions use stablecoins, with over half of non-users expecting adoption in 6–12 months. By 2030, stablecoins could power 5–10% of cross-border payments, worth $2.1–$4.2 trillion.

DWF Ventures highlights stablecoin growth toward $300B - Stablecoin market cap is approaching $300 billion, up 120% since January 2024. Yield leaders include USDf (8.98%), USDe (7.39%), and GHO (7.84%).

Investors rush to swap $323m in Maker tokens - Nearly 82% of MKR tokens have converted to SKY, ahead of a 1% penalty starting September 18.

Avalanche and Hyperliquid lead rally after Fed rate cut - Crypto markets rose broadly after the Fed’s quarter-point rate cut, with investors focusing on the policy signal.

🔍 Policies: UK caps spark Coinbase backlash, Canada warns “move or get run over,” Australia eases licenseUK and US move toward aligned crypto regulation - The UK is set to expand cooperation with the US on crypto regulation, focusing on conduct, AML standards, and stablecoin oversight.

Coinbase pushes back on deposit flight warnings - Coinbase’s Faryar Shirzad said claims that stablecoins threaten bank deposits are unfounded. He noted there is no meaningful link between stablecoin adoption and community bank deposit flight.

Bank of Canada calls for stablecoin regulation - Senior deputy Ron Morrow warned delay risks, saying “you’ll get run over if you just sit there.” The shift moves Canada from CBDC exploration to regulating private-sector stablecoins.

Australia exempts stablecoin intermediaries from licenses - ASIC will exempt intermediaries distributing stablecoins issued by already-licensed firms. This means distributors will not need their own financial services license.

Bank of Italy calls for stablecoin rules clarity - Deputy Governor Chiara Scotti urged clearer laws for multi-issuance stablecoins at the EU level.

🔥 Biz Beats: New U.S. stablecoin, Maple’s $4B boom, and MoonPay’s big M&A move

Stripe crypto lead moves to Polygon amid Tempo build-up - John Egan, Stripe’s former crypto head, has joined Polygon as its first chief product officer. He will focus on expanding Polygon’s role as a stablecoin payments blockchain, supporting Tempo, a chain designed specifically for stablecoin transactions.

ETHZilla adds treasury yield plan and repurchases stock - ETHZilla holds 102,255 ETH (valued at ~$460 million) and $228 million in cash equivalents, alongside a new $80 million financing line from Cumberland DRW.

Circle brings native USDC to Hyperliquid - Circle launched native USDC and its upgraded Cross-Chain Transfer Protocol (CCTP v2) on Hyperliquid’s HyperEVM.

Ethena prepares fee switch as ENA holders eye yields - Ethena confirmed conditions for its ENA fee switch have been met, pending Risk Committee approval and a tokenholder vote. Preconditions included USDe supply above 6 billion, lifetime revenue over $250 million, and integration on four of the top five derivatives venues.

Ripple donates $25m RLUSD stablecoin to veterans and small businesses - Ripple pledged $25 million in RLUSD to Accion Opportunity Fund and Hire Heroes USA. The program is expected to generate $1 billion in economic impact and create 14,000 jobs for veterans and spouses.

EBANX highlights stablecoins at Mexico summit - CEO João Del Valle said stablecoins are becoming the foundation for faster, cheaper, and programmable payment systems.

Kraken partners with Circle to expand USDC and EURC - Kraken deepened its Circle partnership, giving clients more liquidity, lower fees, and new access to EURC. Circle and Kraken aim to build the world’s largest and most widely used stablecoin network.

Space and Time integrates USDC for zk coprocessing - Space and Time added support for USDC payments, automatically converting them to SXT for protocol use.

💡Rollouts: AllScale launches Invoice featuer, PayPal pushes PYUSD across 9 chains, MetaMask rolls out mUSD

Maple expands syrupUSDT to Plasma network - Maple deployed syrupUSDT on Plasma, marking its first move beyond Ethereum. Users can deposit into a Midas-hosted vault for yield and Plasma mainnet rewards.

Polygon boosts block capacity to capture stablecoin growth - Polygon plans to raise its block gas limit, increasing capacity from 1,071 to 1,428 transactions per block.

Google Cloud partners with EigenLayer on secure agentic payments - Google and EigenLayer will add Ethereum restaking security and accountability to AI agent payments.

PayPal USD expands to Tron via LayerZero - PYUSD will be available on Tron as PYUSD0, fully fungible with existing PYUSD across chains.

PayPal’s stablecoin tops $1.3b as it spreads to nine chains - PYUSD expanded to nine blockchains, including Tron, Avalanche, and Aptos, reaching a $1.3 billion market cap.

Nubank adds stablecoin payments to credit cards - Nubank now lets customers pay with dollar-pegged stablecoins directly through its credit card. Brazilians already use stablecoins for 90% of crypto transaction volume; in Argentina, USDT and USDC comprised 72% of purchases in 2024.

Quantexa launches compliance platform for small banks - Quantexa unveiled an AML monitoring tool designed for U.S. mid-size and community banks to reduce false positives.

Transak and MetaMask partner on seamless stablecoin onramps - MetaMask’s Deposit button now exclusively uses Transak to onramp stablecoins like USDC and USDT at near 1:1 rates.

Bitwise files for stablecoin and tokenization ETF - Bitwise applied for the first U.S. ETF targeting both stablecoins and real-world asset tokenization. The fund will split 50-50 between equities and crypto, with 20–30 companies capped at 15% each.

Circle brings native USDC to Hyperliquid - USDC is now live on Hyperliquid’s HyperEVM, supported by Circle’s upgraded CCTP v2 for cross-chain transfers.

Curve Finance proposes $60m yield basis plan - Curve plans to mint $60 million of crvUSD to seed its Yield Basis program with three bitcoin-focused pools.

Ripple, DBS, and Franklin Templeton to list tokenized assets - DBS will list Ripple’s RLUSD stablecoin and Franklin Templeton’s tokenized money market fund.

Rain and Lithic team up on stablecoin card issuance - Rain and Lithic will expand stablecoin-native card programs, processing millions of transactions in 150 countries.

KuCoin Pay enables stablecoin payments at SPAR stores - KuCoin Pay users can now pay with stablecoins at more than 100 SPAR stores in Switzerland. Merchants receive instant fiat settlements without conversion hassles.

YZi Labs increases stake in Ethena Labs as USDe grows - Ethena’s USDe stablecoin surpassed $14 billion in market capitalization. New funds will support expansion on BNB Chain, institutional settlement via Converge, and USDtb integration through Anchorage.

MoneyGram makes stablecoins core of new app - CEO Anthony Soohoo called stablecoins the “killer app” for crypto, enabling real-time settlement.

Crossmint powers MoneyGram’s stablecoin experience - MoneyGram and Crossmint launched a peer-to-peer network reaching 50 million people in 200 countries. Colombian families can now store, spend, and save in dollar-backed stablecoins without keys or gas fees.

South Korea pilots KRW1 won-backed stablecoin on Avalanche - Each KRW1 is backed 1:1 by won held at Woori Bank, with real-time proof of reserves via API integration.

USDD launches natively on Ethereum with rewards campaign - USDD went live natively on Ethereum on September 8 with a Peg Stability Module for instant swaps.

Plasma to launch mainnet and XPL token with $2b TVL - Plasma’s mainnet goes live September 25 with $2 billion TVL and over 100 DeFi integrations.

Coinbase introduces USDC onchain lending up to 10.8% - Coinbase now lets users lend USDC onchain with current yields up to 10.8%.

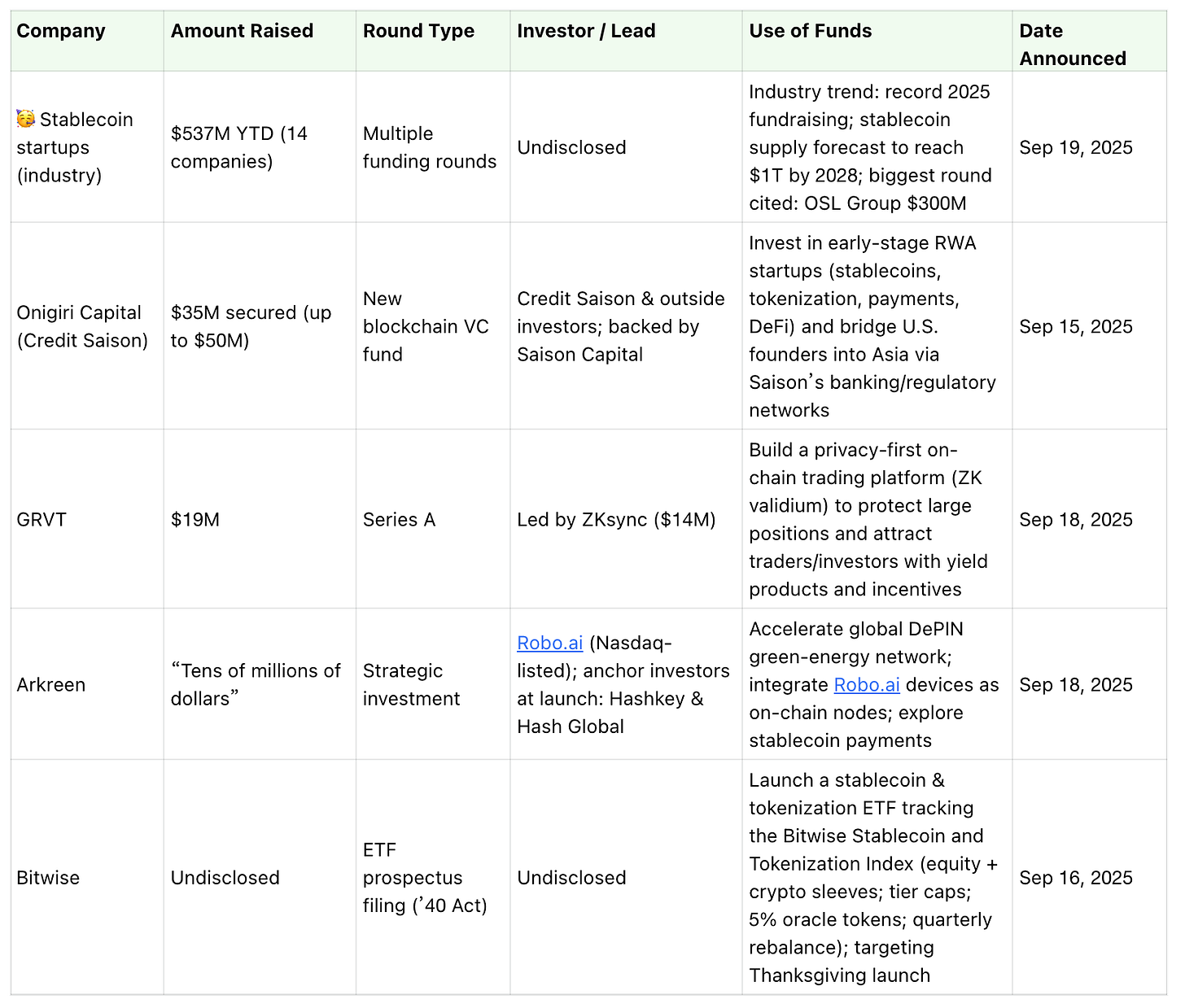

💲Money in motion: This week’s hottest stablecoin industry financing moves!

👋 That's your stablecoin scoop for the week.

Until next time — AllScale Weekly

👉 Learn how AllScale can help your team pay, invoice, and scale globally

AllScale is a financial technology developer, not a bank and does not provide digital assets custodian services.